Prefer to listen to a podcast about accounting firm automation?

Estimated reading time: 7 minutes

Table of contents

- Prefer to listen to a podcast about accounting firm automation?

- The Automation Gap—Why Most Firms Are Stuck

- What Accounting Firm Automation ROI Actually Looks Like

- The Five Areas Where Automation Drives Maximum Impact

- How RightFit Executes Automation Without Adding to Your Workload

- The Bottom Line on Accounting Firm Automation ROI

You’ve been told accounting automation is the answer to your firm’s capacity problems. But when you’re already stretched thin, investing in new technology feels like one more thing on an already impossible list.

Here’s the frustration: you know your firm needs better systems. You’ve seen competitors pull ahead. You’ve watched top talent leave for firms with modern workflows. But between client deadlines, staff management, and the daily fires you’re putting out, who has time to research tools, build integrations, and train the team?

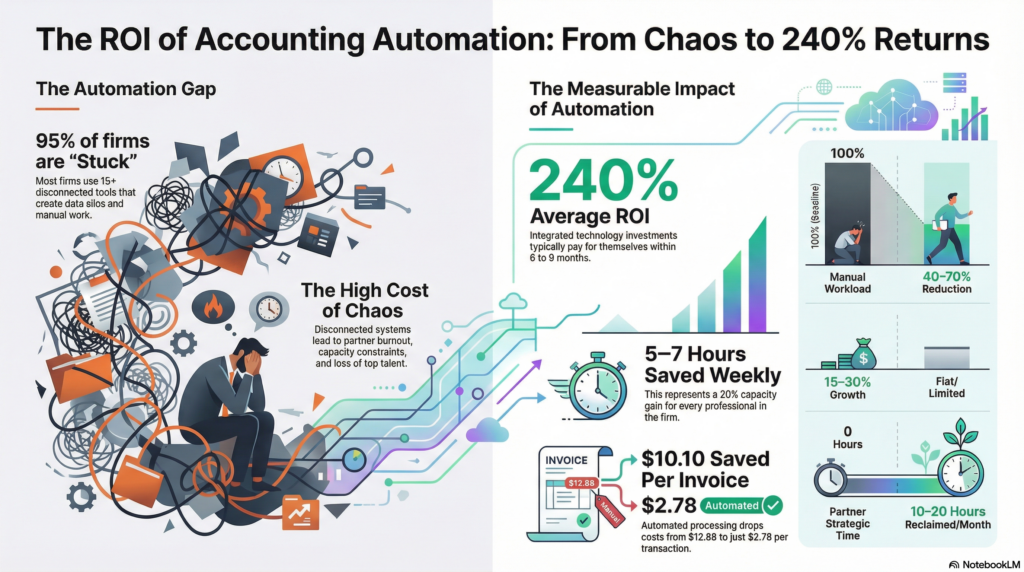

This article breaks down the measurable ROI of accounting firm automation, what’s actually worth investing in, and how firms are implementing automation without adding to partner workload. Because the data is clear: firms that integrate automation strategically are seeing 5-7 hours saved per professional per week, 40-70% reduction in manual work, and average ROI of 240% within 6-9 months.

The question isn’t whether automation pays off. It’s whether you have someone to make it happen.

The Automation Gap—Why Most Firms Are Stuck

Here’s the irony: 95% of accounting firms have already adopted some form of automation. But most are juggling 15 or more disconnected tools that create more chaos than efficiency.

You’ve probably lived this. Someone bought a client portal. Another partner invested in workflow software. Marketing set up an email platform. But nothing talks to each other. Data lives in silos. Your team is manually copying information between systems. And the promised efficiency gains never materialized.

Why does this happen? Because firms buy tools without an integration strategy. No one owns the implementation. And partners are too busy serving clients to oversee the rollout properly.

The cost of this automation gap is real. It shows up as partner burnout when you’re working nights and weekends. It appears in capacity constraints that limit growth. And it becomes painfully visible when your best people leave for firms with better systems.

This is where RightFit’s Automation Framework makes the difference. We don’t just recommend tools—we build and run the systems for you. Because knowing what to automate and actually implementing it are two completely different challenges.

What Accounting Firm Automation ROI Actually Looks Like

Let’s talk numbers. Not theory, but measurable outcomes firms are seeing right now.

Time savings: Firms integrating automation report saving 5-7 hours per professional per week. That’s not a small improvement—it’s getting 20% of your team’s capacity back. In accounting practice automation, processing costs drop dramatically. Manual invoice processing costs about $12.88 per transaction. With automation, that drops to $2.78. That’s a $10 savings on every single invoice.

Revenue impact: When you free up capacity, you can serve more right-fit clients without adding headcount. Firms implementing systematic automation see 15-30% revenue growth. Better yet, improved client experience through consistent communication and faster response times drives retention. Your best clients stay longer and refer more.

Partner time reclaimed: This is the game-changer. Managing partners report getting 10-20 hours back per month for strategic work and business development. Not hours spent firefighting or doing work that should be delegated—actual time to work on the business instead of in it.

Talent retention: Reduced burnout means keeping your best people. And when you’re competing for top talent, having modern systems makes your firm significantly more attractive. Your team wants to work with technology, not against it.

The proof is in the data: companies investing in CPA firm technology see an average ROI of 240% with payback in just 6-9 months. Firms consistently report 40-70% reductions in manual work after proper implementation.

The Five Areas Where Automation Drives Maximum Impact

Not all automation delivers equal value. Based on work with hundreds of accounting firms, these five areas consistently produce the highest accounting firm automation ROI:

1. Client onboarding and intake: Automated data collection, document requests, and engagement letters eliminate the back-and-forth that drains associate time. Clients get a professional, streamlined experience. Your team gets complete information upfront instead of chasing missing details mid-engagement.

2. Workflow and task management: Recurring tasks, deadline tracking, and automated assignment ensure nothing falls through the cracks. Partners stop being the bottleneck because the system routes work automatically based on capacity and expertise.

3. Communication and cross-sell: Systematic touchpoints identify advisory opportunities your team would otherwise miss. When you’re not relying on memory or random conversations, you catch client needs at the right moment. This turns into real advisory revenue growth.

4. Marketing and lead generation: Email nurture sequences, social media posting, and website lead capture run on autopilot. Marketing becomes a system that works even when you’re busy. This is how firms break free from referral dependency.

5. Internal processes: Automated billing, time tracking, and reporting dashboards give you real-time visibility into firm performance. You make decisions based on data instead of gut feel. And your team spends less time on administrative work that doesn’t serve clients.

The key insight: these areas connect. Client onboarding feeds into workflow management. Communication systems identify marketing opportunities. It’s not about implementing five separate solutions—it’s about building an integrated approach.

How RightFit Executes Automation Without Adding to Your Workload

Here’s the challenge every managing partner faces: you know what needs to happen. You’ve probably made a list. But who actually does the work?

Most consulting firms hand you a strategy deck and leave. Marketing agencies only handle one piece. And your internal team is already maxed out. So the implementation plan sits in a drawer while nothing changes.

This is where RightFit takes a fundamentally different approach.

We audit your current systems and identify the highest-impact opportunities specific to your firm. Not a generic checklist—actual analysis of where you’re losing time and money right now.

We build the integrations and workflows using tools you already own, plus strategic additions where needed. We handle the technical heavy lifting: connecting systems, building automations, setting up templates, and training your team.

We manage ongoing optimization. You approve strategic decisions. We handle execution. Your typical commitment is 2-4 hours per month for input and approvals—not 20+ hours trying to figure out how to make systems work.

This is execution-first partnership. We don’t tell you what to do and walk away. We assume responsibility for getting it done.

And here’s what makes this truly powerful: automation doesn’t exist in isolation. It connects to everything else in your firm. Our approach integrates across all five of RightFit’s frameworks:

– Strategy: Automation helps you serve more right-fit clients by freeing capacity

– Messaging: Automated communication delivers your value proposition consistently

– Marketing: Lead generation systems work around the clock

– Communication: Cross-sell automation identifies advisory opportunities systematically

– Automation: The foundation that makes everything else scalable

The result? Predictable growth with freed partner time and clear KPIs showing measurable impact. You’re not just buying tools—you’re getting a complete transformation from concept to implementation.

The Bottom Line on Accounting Firm Automation ROI

Let’s bring this back to what matters for your firm.

Accounting firm automation ROI is measurable and significant. We’re talking 240% average returns with 6-9 month payback. That’s not a projection—it’s what firms are actually seeing.

But here’s what the statistics don’t capture: the relief of finally having systems that work. The satisfaction of watching your team thrive instead of burn out. The freedom to focus on strategic leadership instead of tactical firefighting. The pride in building a firm that attracts both the best clients and the best talent.

The gap isn’t knowing what to do. You already know automation matters. The gap is having someone execute it for you.

That’s what RightFit’s Automation Framework delivers: implementation without adding to your already-full plate. We do the heavy lifting while you stay focused on what you do best—serving your clients and growing your firm.

Ready to see where automation can drive the highest ROI in your firm? Schedule Your Discovery Call to discuss your specific challenges and opportunities. We’ll show you exactly what’s possible—without asking you to do the work yourself.

—

RightFit Accounting Performance Group helps small-to-mid-sized accounting firms achieve predictable, sustainable growth through execution-first services. Unlike traditional consultants who provide strategy and leave, we assume responsibility for ongoing implementation across positioning, marketing, communication, and automation—freeing partner time and driving measurable results.